The Containment Trap

Most conversations about voice AI in insurance are focused on containment, measuring success by whether we prevented the customer from reaching a human agent.

But there’s a hidden cost to this metric. A call can be “contained” and still create weeks of manual work after the phone hangs up. When you focus solely on the conversation, you ignore the fragmented hand-offs between teams, silos, and systems that follow.

If you’re only measuring whether the caller hung up, you’re simply perfecting the "horseless carriage". Companies today are using LLMs to make the front office sound better while staying tethered to an outdated model where the front office “talks” and the back office “works”.

The Old World

This divide isn't new; it is the result of three decades of defensive layering.

1-800 Era: The customer was the triage agent. You’d navigate a web of numbers for billing, claims, or changes. If you guessed wrong, you’d be re-routed, starting the cycle over.

Deflection Era: As the cost of human service and expense pressures climbed, companies built complex IVRs and self-service apps designed to manage costs.

The result is a widening execution gap that creates systemic failures:

Operational drag: Most requests require updates to core systems but with front and back office siloed, data is simply tossed over a wall to downstream queues. A simple endorsement request turns into weeks of re-keying and manual follow-ups, leaving the customer in limbo for a task that should have been in good order from the start.

Inelasticity crisis: When a catastrophe strikes, a surge in First Notice of Loss (FNOL) calls can instantly overwhelm the front office and create a months-long backlog. These spikes are notoriously difficult to forecast and anticipating them also runs the risk of over-staffing and higher shrinkage costs.

Pace: Your Agentic Workforce

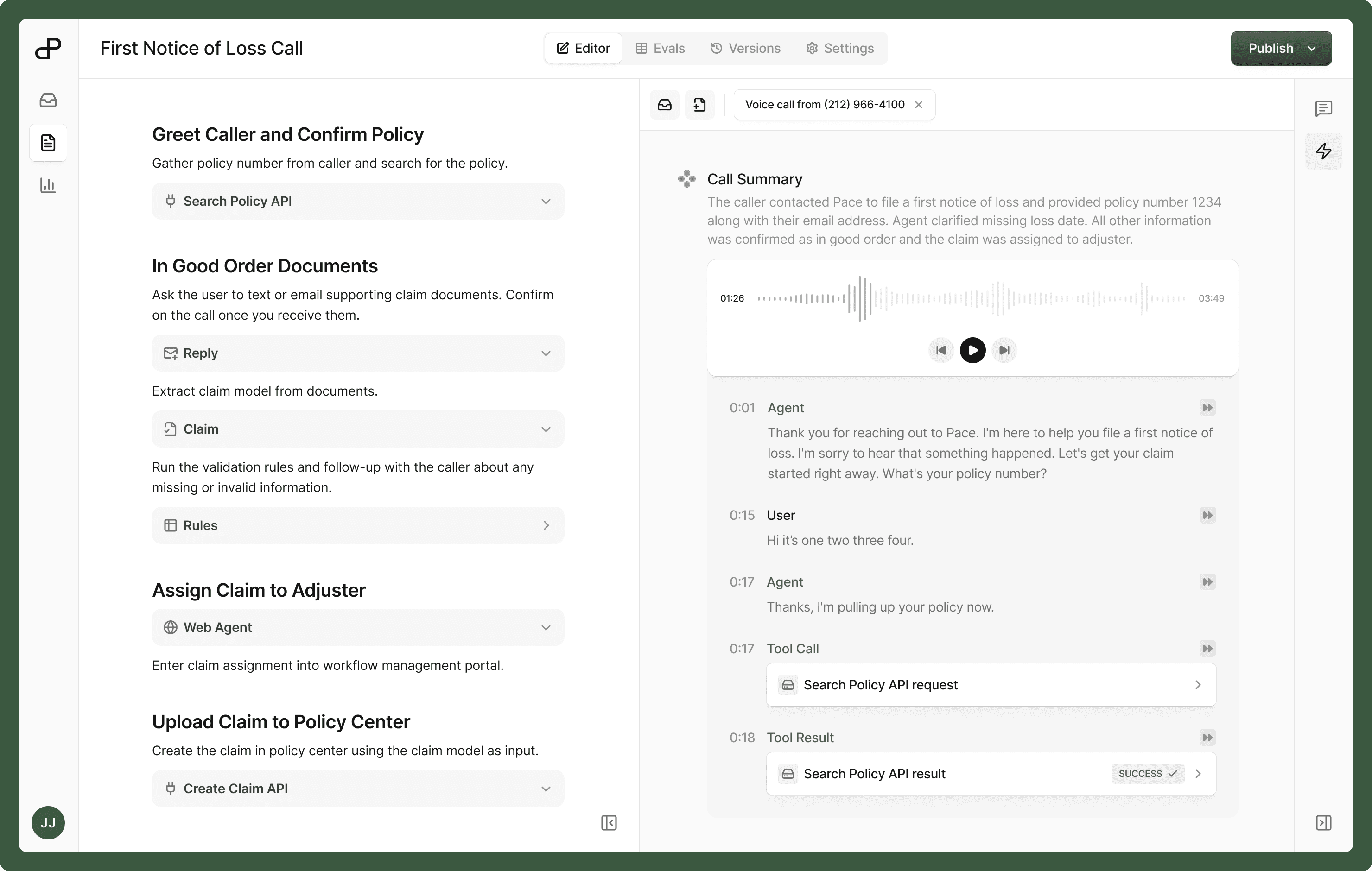

Pace is defining a new era. We’re replacing “containment” with closure. That means a policy endorsement call isn’t complete until the agent has verified the data as in good order, triaged the premium impact, and updated the policy in the system of record.

To do so, we’ve collapsed the wall between front and back office with a single agent that manages end-to-end workflows: starting with a conversation, applying complex business logic, and writing directly to your core systems.

Pace agents are built on three pillars:

1. Multi-modal coordination

Voice is synchronous (requiring sub-second latency) but emails, portal updates, and document parsing are not. Every interaction is routed to an orchestrator that bridges identities across channels in real-time. If a homeowner calls to report a damaged roof, they can take photos of the shingles and send them over WhatsApp mid-call. The agent parses them immediately, validating rules and adjusting the claim without breaking the conversation.

2. System integration

Most integrations are shallow read-only lookups but true closure requires navigating complex data models, custom APIs, and security rules in platforms like Guidewire or Pega. In a Claims QA flow, Pace agents cross-reference loss details from a call against specific policy exclusions and limits, before writing directly to the system of record.

3. Long-running agents

Insurance is a marathon of follow-ups where workflows often span weeks. Our persistent, event-driven architecture allows an agent to wait for external signals. In a Workers’ Comp Premium Audit, a Pace agent might request payroll records and wait for the upload. If a broker calls back and misses the agent, the thread isn't lost. The agent picks up with full context, reconciles the new data, and triggers the final billing adjustment.

Beneath these pillars is a foundation that handles the nonnegotiables: native telephony and CCaaS integration, deterministic guardrails for auditability, and an architecture built to scale.

Containment to Closure

Pace agents bridge the gap between your front and back office systems. By unifying voice, follow-ups, and core system execution, we eliminate the hand-offs where workflows usually break down.

The result is insurance AI that doesn't just contain. It finishes the job.

To see what closure looks like in practice, request a demo here.